The decentralization, security, and global inclusivity that crypto provides have inspired a new era of financial innovation. It’s one that attracts the interest of some of the world’s most influential investors, including crypto venture capital (VC) firms.

VC firms typically provide both financial and strategic guidance with their partners, as well as industry resources and market accessibility. In cryptocurrency, these firms are hedging bets about the future of finance, governance, security, and more.

Is crypto VC funding the same as regular VC funding?

While the process of pitching a project, negotiating stakes, and coming to an agreement is the same, the means to receive equity differs. Traditional businesses exchange portions of their stock ownership for the much-needed capital to fuel growth and expansion.

Conversely, crypto VC funding frequently involves buying tokens — or the currency used within the project. Receiving an amount of the currency supply (in exchange for investment) effectively grants investors a stake in the project’s future success, assuming they hold.

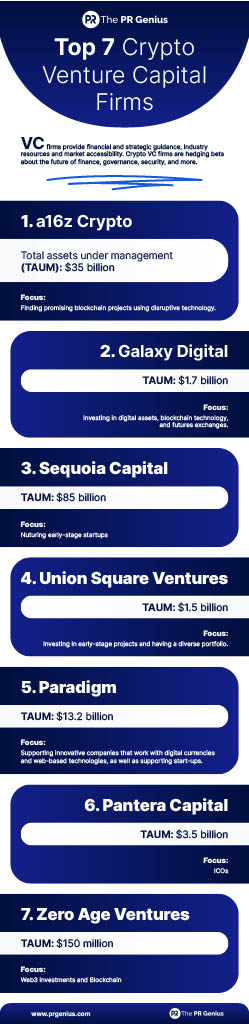

The top 7 crypto VC funds

These seven crypto venture capital funds have become industry front-runners, leading the future of crypto investments:

1. a16z (Crypto VC arm)

Total assets under management (TAUM): $35 billion

A16z Crypto (a fund under Andreessen Horowitz) has carved out a niche for itself in the blockchain arena. It brings the firm’s deep tech expertise into the crypto world, betting big on disruptive technologies.

With successful investments in OpenSea and Uniswap, a16z Crypto demonstrates its sharp acumen in identifying and supporting promising blockchain projects.

2. Galaxy Digital

TAUM: $1.7 billion

Led by the “Bitcoin Billionaire” Mike Novogratz, Galaxy Digital champions the institutional adoption of digital assets and blockchain technology. The firm’s investment in Bakkt (a regulated Bitcoin futures exchange) and leading crypto management platforms signify its current success.

Founded by industry leader Mike Novogratz, the fund has also invested in projects like OneOf, Certora, Skolem Technologies, and Encode Club.

3. Sequoia Capital

TAUM: $85 billion

Sequoia Capital is primarily known for its technology investments including Google, LinkedIn, and Apple — and is one of the world’s leading venture capital firms. In crypto, the firm continues its tradition of nurturing early-stage startups.

Its crypto assets include significant investments in Coinbase and Ripple, as well as emerging ventures like Caldera, Handshake, Multis, Privy, and Strips Finance. With these investments, Sequoia has leveraged its industry reputation into more fruitful partnerships.

4. Union Square Ventures

TAUM: $1.5 billion

Renowned for investing in early-stage projects, Union Square Ventures stands out in the blockchain and cryptocurrency industry. Its portfolio hosts some of the biggest names in cryptocurrency, including Coinbase, Ripple, Circle, and Paxos — an extremely diverse portfolio.

5. Paradigm

TAUM: $13.2 billion

Paradigm is known for supporting innovative companies that work with digital currencies and web-based technologies. They’ve put their money into successful projects like Ethereum, MakerDAO, Filecoin, 0x, and DFINITY. Well-known in the industry for its strong support for startups, Paradigm often offers money, strategic advice, and help with business operations.

6. Pantera Capital

TAUM: $3.5 billion

Pantera Capital has established its name by backing some of the crypto industry’s most successful companies like Circle, Coinbase, and Ripple. Notably, Pantera Capital played a key role in igniting the ICO boom of 2017, showcasing its ability to stay ahead of the curve.

Their firm is highly respected in the crypto VC space, owing to their vast network of over 1,000 strategic partners and investors. Its access to resources such as capital, talent, and market intelligence favorably positions it for future investment opportunities.

7. Zero Age Ventures

TAUM: $150 million

Emerging from the legacy of the Kosmos Fund, Zero Age Ventures represents a new chapter in web3 investment. The fund has been part of the blockchain journey since 2017 and has supported several notable projects, including Solana, Algorand, and Polkadot.

Crypto VC investments continue to stay strong

2020 saw a massive amount of venture capital make its way into the crypto industry. Unfortunately, over the last few years, this capital has dwindled down due to the ongoing bear market.

However, that doesn’t mean investments have stopped. New and old names continue to emerge and enter the web3 arena. In fact, Blackrock recently made news with its applications for a Bitcoin ETF that may bring billions to Bitcoin and other cryptocurrencies.

Only time will tell, but the future of crypto and web3 continues to look bright.

Looking to lock in funding for your Web3 project? Book a call today and see how our crypto PR services can help you secure the funding you need for success.